I know that by now you have heard about Cryptocurrency and blockchain. Crypto is still a hot topic among tech and finance enthusiasts. You may be wondering if at all crypto coins take the value of a real currency.

The other questions are about the terms of trading cryptocurrency. Is the commodity a legal coin? Can it have any penalties for not following the rules or laws that govern finance?

This post should answer your questions about bitcoin, Ethereum, and altcoins. You will also understand how tax applies to these coins when you involve yourself in the business.

What is Cryptocurrency?

As a simple introduction, a cryptocurrency is a form of “accepted currency” that works on digital platforms. As a decentralized currency, crypto works anywhere in the world. You can buy and sell, exchange, or trade Cryptocurrency without limits. Click To Tweet

In short, crypto coins open up opportunities to people around the world. It is an avenue poised to change finance. But there are various types of Cryptocurrency, and each of them came up to meet a specific role in the digital world. Let us look at some of them.

Bitcoin

When Cryptocurrency came into existence, Bitcoin was the first coin to launch. The developer, Satoshi Nakamoto, whose real name is unknown, created the currency in 2009. Bitcoin is still the most significant coin in the market share of Cryptocurrency.

When looking at the value of crypto coins, bitcoin still has the most significant price. The reason is that many investors and traders found out that the currency solves many peoples’ needs to transfer money across borders within the minimum time possible.

Bitcoin did not only make it possible to transfer funds and make payments faster. It also removed the international money transfer barrier as well as the vast transaction fees for cross-border payments. It is the preferable solution where PayPal and other payment processors are not fully supported.

But the story did not end there. Bitcoin has made many people rich with their investments since the coin went live. Those who bought it when the price was a few cents reaped the best returns when in late 2017 the coin hit close to US$ 20k. Currently, the amount of bitcoin is US$ 10 700.

Ethereum

Sometimes, many people confuse the words Ethereum and Ether. It is easy to interchange their meanings and application. But Ethereum is a blockchain platform while Ether is the crypto coin that operates on the Ethereum network.

But it goes beyond that. Apart from working as a computing platform for processing coin transfers, Ethereum is also an operating system that powers the technology. Its launch was a “smart contract” service.

Ethereum powers the development of many apps that allow people to secure their services without fraud possibilities. Ethereum-backed applications are fast and free from censorship.

Running on the Ethereum network is Ether, the second-largest cryptocurrency in market share. But other apps that run on the Ethereum blockchain have their own coins. These coins and many others fall under the Altcoin category.

Altcoins

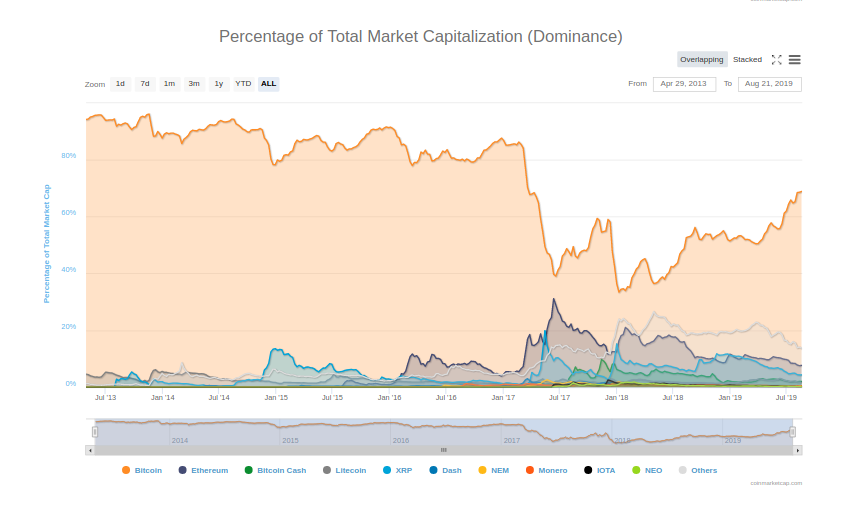

At the time of writing this post, there was a total of more than US$ 279B in the cryptocurrency market. There are also more than 5k crypto coins in total. You cannot even tell the prices of some of these coins. But you will find that there are coins that try to imitate the structure of others.

The graph below shows some of the top crypto coins and currencies you may have an interest in. They are the top in market share at the moment.

To buy any cryptocurrency of your choice, you need to create a “wallet” that will hold the coins you buy until you transfer them out. There are many options to choose from, and Bitvavo offers you the hassle-free solution for buying all the major coins with a secure account.

Taxation of Cryptocurrency

Cryptocurrency is still “new” to many people, and governments do not recognize it as anything serious. Some authorities deem trading crypto to be an illegal activity. But some countries and governments have embraced the digital assets to help their citizens access the services they need.

But you know that the freedom of using Cryptocurrency to pay and trade on various platforms securely does not allow anybody to evade taxation. IRS treats Cryptocurrency as a property that US residents own.

Whatever transactions you do relating to Cryptocurrency has a strong impact on your tax returns. The IRS bulletin (issued in 2014) indicates that every gain or loss you make should appear in your tax form entries.

But it seems that people were not ready or aware of how to compile their cryptocurrency transactions and ownership for tax filing. Through the 2013 – 2015 period, the taxpayers that reported their gain from crypto coins do not exceed 900.

We can assume that many taxpayers do not know if the law requires the filing of crypto transactions. Some of them may not have an understanding of the process of filing their purchases on the tax forms. But, (I hope not), some people will ignore and try to ride freely on this “anonymous” digital solution.

The bad news for the tax evaders is that IRS has formed a team of experts and investigators to crack down on the offenders and ensure they answer responsibly. Coinbase is supposed to forward the information of people with over US$ 20k in Cryptocurrency for further investigation.

Summary

Crypto coins are beneficial for our daily activities. When the governments will see the essence of tapping into the resource, they can help to protect their citizens with the use of cryptocurrency and legalize the payments.

In this way, they can tax the income people make from trading in cryptocurrency. The gains from the taxes can help in improving or implementing the governments’ agenda to grow their economies.

Featured Image Credit: Pixabay

Interested in taking your business to the next level? Reach out to us through the form below and let’s help transform your business into a sales machine!

- 6 Tips to Maximize the Impact of Handwritten Notes - 03/09/2019

- Crypto Coin & Its Taxation: Bitcoin, Ethereum, and Altcoin - 23/08/2019

- 8 Challenging Business Skills You Need to Master - 19/07/2019